In this article:

When you're hit with an emergency expense or you have multiple debts that feel overwhelming to manage, a personal loan might offer some relief. A personal loan gives you an immediate infusion of cash that you pay back in regular installments over a set period of time. But, is a personal loan possible if your credit is only fair?

Depending on a number of factors—including your credit score, how much you need to borrow and how much you can afford to pay monthly—a personal loan may indeed be an option for you. Here's what to know about getting a personal loan with fair credit.

What Is Considered Fair Credit?

A FICO® Score☉ Θ of 580 to 669 is considered fair. FICO® Scores range from 300 to 850 and fall into the following five categories:

| Rating | Credit Score |

|---|---|

| Poor | 300—579 |

| Fair | 580—669 |

| Good | 670—739 |

| Very good | 740—799 |

| Exceptional | 800—850 |

Your FICO® Scores are based on information in your credit reports maintained by the three major credit reporting agencies: Experian, TransUnion and Equifax. In calculating your credit score, FICO considers your payment history, credit utilization rate (or how much you owe compared to your credit limits), length of credit history, credit mix and requests to check your credit.

Can You Get a Loan With Fair Credit?

It's possible to get a loan with fair credit, but you may have a harder time finding a loan. Lenders use your credit score to size up the risk involved in lending you money. Good or excellent credit shows that you have experience managing credit and have successfully repaid debt. A fair credit score suggests you might be relatively new at using credit or that you've had some setbacks in the past, making you a higher risk to lenders.

How Fair Credit Affects a Personal Loan

If you have fair credit, expect to do a bit more work finding a loan. Having less-than-perfect credit may affect your loan search in four ways:

- It may be harder to find a lender. Some personal loan companies have minimum credit score requirements that may disqualify borrowers with fair credit.

- You may pay more in interest and fees. The best interest rates and lowest fees are generally reserved for applicants with excellent credit. Higher rates and fees may be seen as a hedge against the higher risk associated with lending to applicants with fair credit.

- You may get a smaller loan. Getting approved for a large loan may be more difficult with fair credit, especially if your income is lower.

- You may have to repay your loan faster. Sometimes you may need a higher credit score to unlock a longer loan term. That said, a shorter loan term does not mean having to repay your loan in two or three weeks; instead, it could mean you'll only qualify for a term of two years as opposed to five years, for example.

How to Get a Personal Loan With Fair Credit

Even though it may be more difficult to qualify for a loan if you have fair credit, it is possible. Here's how.

1. Check Your Credit

To avoid any surprises, review your credit reports at all three credit reporting agencies for free through AnnualCreditReport.com. You can also see your credit score and credit report from Experian for free at any time.

2. Decide How Much You Need

Though you may find yourself limited by what lenders are willing and able to offer, start by figuring out how much you need—to get your car running again, reorganize credit card debt, replace your broken refrigerator or fix whatever financial challenge you might be facing.

3. Factor in Income and Assets

In addition to checking your credit, lenders will want to know about your ability to repay a loan. Lenders typically require proof of income and may also want to see proof of savings or other cash assets you can use to repay your loan if necessary.

4. Find the Right Lender

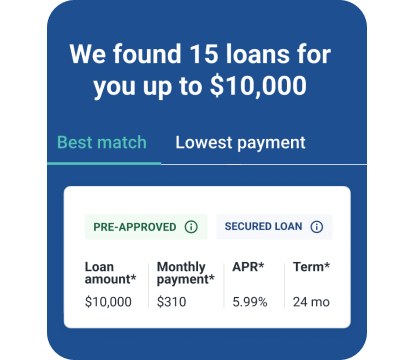

You can start with the bank or credit union you already use, or consider checking out Experian's comparison tool that matches you with a list of potential lenders based on your credit profile. An online tool can help you home in on lenders that are most likely to work for you. Because loan rates and terms can vary greatly, shopping multiple options can be key to finding the best possible loan for your circumstances.

Find a personal loan matched for you

5. Avoid Payday and Title Loans

Payday lenders and title loan lenders cater to borrowers with imperfect credit. But sky-high interest rates, ultra-short loan terms and automatic renewals or title forfeitures can leave borrowers in worse financial shape than when they started.

6. Get Prequalified or Preapproved

Once you've narrowed your options down, take the next step. Having a lender (or a few lenders) prequalify or preapprove your loan will give you more detailed information—and a better idea of whether your application will actually be approved.

7. Consider a Cosigner

You may improve your chances of getting a loan approval, or favorable rates and terms, if a friend or family member with good credit is willing to cosign your loan. A cosigner puts their credit on the line to vouch for you. They're also pledging responsibility for the loan if you can't pay it. Before asking someone to cosign for you, make sure you both understand how it could affect their credit, and what will happen if you're unable to pay.

How to Improve Your Credit

If you aren't having luck finding the loan you want with fair credit, consider taking some time to try improving your credit score. Here are a few tactics to try:

- Make your payments on time. Even one 30-day late payment can bring down your credit score—and stay on your credit report for up to seven years.

- Try Experian Boost®ø®ø. Add on-time rent, phone and utility payments to your Experian credit score calculation, which may instantly raise your credit score.

- Pay down debt. Reducing the balances on your credit cards or paying off existing loans will help raise your score.

- Be careful with new credit and inquiries. Too many hard credit inquiries and new accounts can lower your score. Try to limit credit applications and new accounts until after you get the loan you want.

- Correct inaccuracies. Although you can't remove accurate information from your credit report, you have the right to dispute information that's incorrect.

Turning a fair credit score into a good one may take months—or longer. But an improved credit score may qualify you for a bigger loan with better terms and a lower interest rate. If you have the time, it may be worth the wait.

The Bottom Line

Finding the right personal loan can be a challenge when you have fair credit. It may be more difficult finding a lender that will work with you, and it can be harder to find a loan that truly fits your needs. A personal loan is a helpful tool when you need to finance an emergency expense or reorganize debt, but it works best when the interest rate and monthly payments are affordable and the loan amount is large enough to fit your financial purpose.

While you're looking for the right loan, consider free credit monitoring with Experian. You'll receive alerts when there's a change to your credit file, so you can stay up to date and on track as your credit improves.