In this article:

A balance transfer credit card or debt consolidation loan can help you combine debts and save on interest while paying off your balances. Neither is necessarily better than the other in every situation, and comparing the two can be important if you're trying to strategically pay off debt.

Which option is right for you likely will come down to your credit, how much you need to pay off and how much you are comfortable paying in fees.

| Balance Transfer Card | Debt Consolidation Loan | |

|---|---|---|

| Intro 0% APR offers | Yes | No |

| Standard APR | May be higher than the APR on a loan | Often lower than credit cards' standard APRs |

| Pays off most types of debt? | Depends on the card issuer | Yes |

| Approval amount | Depends on the card's balance transfer limit | Depends on your approved personal loan amount |

What Is a Balance Transfer?

A balance transfer is when you move balances from one or more credit cards to another card. Some card issuers also let you transfer a balance from an outstanding loan to your balance transfer credit card or from your card to a bank account. Additionally, you might be able to use a balance transfer check to pay off other debts or deposit funds into your bank account.

A balance transfer could help you save money if you receive a low promotional annual percentage rate (APR) on your balance transfer card. For example, some cards might offer an intro 0% APR on transferred balances for up to 21 months. If you pay off the card before the promotional rate ends, you won't pay any interest on the transferred balances.

Credit card issuers often use promotional balance transfer offers to entice new cardholders, but you might occasionally receive balance transfer offers on the cards you already own.

Looking for a new credit card?: Check out the best balance transfer credit cards.

Pros and Cons of Balance Transfers

Balance transfer cards can help you combine and pay off debts, but consider the advantages and disadvantages.

Pros

- Save money with an intro 0% APR offer. You may be able to move debt from a high-rate credit card or loan to a card with an intro 0% APR and avoid accruing interest during the promotional period.

- Get more time to pay off balances. Transferring balances can give you more time to pay down the balance while you aren't accruing interest.

- Consolidate multiple debts onto one card. You can transfer balances from multiple credit cards and loans to consolidate your debts. It may be easier to manage your finances and pay off debt if you have fewer bills to pay each month.

- The intro 0% APR may apply to purchases. You generally don't earn rewards on balance transfers, but some rewards cards also offer an intro 0% APR on purchases. You could use them to earn rewards on purchases you were going to make anyway without accruing interest. However, if your card's 0% intro APR only applies to balance transfers, avoid using it to buy things until after you pay off the transferred balances.

Cons

- You'll often pay balance transfer fees. Many card issuers charge a balance transfer fee of 3% to 5% of each amount you transfer to the card. You can compare the cost of the fee to the potential interest savings to see if the card is a good idea.

- Balance transfer cards might have high standard APRs. Once the promotional period ends, your remaining balance could accrue interest at the card's standard APR.

- You won't know the credit limit you'll be offered. Your credit card's credit limit and balance transfer limit can depend on your credit, income, debts, history with the issuer and the card. You can't transfer more than your balance transfer limit, and you won't know your limit until after you apply.

- Each application might hurt your credit. Credit card applications can lead to hard inquiries on your credit report, which can hurt your credit scores a little, even if your application isn't approved.

- Credit card companies may have restrictions. You usually can't transfer balances between cards from the same issuers. Some cards also only allow balance transfers from credit cards (not loans).

Learn more: Should I Complete a Balance Transfer?

What Is a Debt Consolidation Loan?

A debt consolidation loan is a loan you use to pay off other debts. Consolidating debts can save you money if your new loan has a lower interest rate than your other debts. You'll also have fewer payments to manage, and your monthly payment might be lower than the previous combined monthly payments.

Unsecured personal loans are a popular option for debt consolidation loans. Some personal loan lenders even advertise their personal loans as debt consolidation loans and create website pages to highlight this use of the loan.

You could also consolidate debts using different types of loans, such as a home equity loan or home equity line of credit. However, unsecured personal loans are often favored because you don't need collateral to get the loan—your eligibility, loan amount and terms can depend on your creditworthiness and promise to repay. When you use a secured loan, such as a mortgage, to pay off other debts, you risk losing the collateral if you fall behind on loan payments.

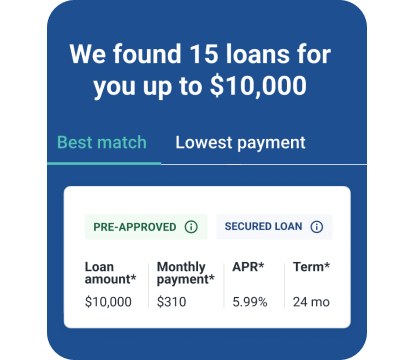

Find a personal loan matched for you

Pros and Cons of Debt Consolidation Loans

Taking out a new loan to pay off existing debt can be a savvy move, but keep the following in mind.

Pros

- Low APRs may be available. Personal loans don't offer introductory 0% APRs, but you might qualify for a low interest rate based on your creditworthiness.

- Get prequalified without hurting your credit. You can try to get prequalified for a personal loan with a soft credit check—the type that won't hurt your credit scores. If you're prequalified, you might see estimated loan amounts and interest rates. If you aren't prequalified, at least you won't take the potential credit hit that can come from submitting a loan application.

- Lock in fixed rates and terms. Unsecured personal loans tend to have fixed interest rates, and you may be able to choose from several repayment terms, such as three or five years. You'll then have fixed monthly payments and will know your loan's payoff date.

- It might improve your credit scores. Using an installment loan to pay down credit card balances could lower your credit utilization rate, and a lower utilization rate is better for your credit scores.

Cons

- You might have to pay an origination fee. Many unsecured personal loan lenders charge an origination fee, which might range from 1% to 12% of the loan amount. The fee gets taken out of your loan's proceeds, so you might need to borrow more than your outstanding balance. If you have good to excellent credit, you might qualify for a personal loan without an origination fee.

- It could lead to more debt. Some people use a debt consolidation loan to pay off credit card balances and then wind up back in credit card debt too. If you tend to overspend or make impulse purchases, freeing up available credit on your credit cards might not be the best solution.

- You might not receive a low rate or high loan amount. Even if you prequalify, you might find you only get approved for a loan with a higher interest rate than your outstanding debt. Or, you might get approved with a lower rate but only for a loan that can pay off part of your outstanding debt.

Learn more: Is a Debt Consolidation Loan Right for You?

Which Is Better: A Balance Transfer Card or Debt Consolidation Loan?

Both balance transfer cards and debt consolidation loans can help you consolidate debt and accrue less interest. However, you can compare offers and consider your finances when trying to determine which will be best.

| When to Choose a Balance Transfer Card | When to Choose a Debt Consolidation Loan |

|---|---|

|

|

To help you decide if a balance transfer card is right for you, run the numbers to see how much your existing credit card debt will cost you over time. If you transfer it to a balance transfer card with an intro 0% APR, you could avoid all that interest—just pay off the balance before the intro period ends.

Credit Card Payoff Calculator

†The information provided is for educational purposes only and should not be construed as financial advice. Experian cannot guarantee the accuracy of the results provided. Your lender may charge other fees which have not been factored in this calculation. These results, based on the information provided by you, represent an estimate and you should consult your own financial advisor regarding your particular needs.

Try the full Credit Card Payoff Calculator Opens a new window with more features.

Frequently Asked Questions

Does Debt Consolidation Hurt Your Credit?

Applying for and opening a new credit card or loan can hurt your credit scores regardless of how you use the account. Consolidating debt can also have positive and negative impacts depending on whether you're using a credit card and if you're paying down balances or paying off accounts. In general, if you manage the new account well by consistently paying down its balance and making on-time payments, you could see your credit scores increase over time.

What Are Alternative Ways to Pay Off Debt?

There are many alternatives to using balance transfer cards and debt consolidation loans:

- Stick with debt payoff strategies. Look for ways to make extra money or save money and then use that money to implement a debt payoff strategy. For example, with the debt snowball method, you'll focus on paying off the account with the lowest balance first to build momentum. With the debt avalanche method, you'll pay off the account with the highest interest rate first to minimize how much you spend on interest.

- Try a debt management plan. Credit counselors offer debt management plans (DMPs) to clients who are having trouble with credit cards and other unsecured debts. The counselor can try to get your card issuers to waive fees and lower your interest rates, which can decrease your monthly payments. They also collect a single monthly payment from you and distribute the funds to your card issuers. DMPs generally lead to paying off the included debts within three to five years, but you may need to close your credit cards and can't apply for a new card while you're on a DMP.

- Contact your creditors. If you're struggling with monthly payments and are looking for a short-term solution, you can ask your lenders if they offer any hardship programs. You might qualify for a temporarily lower interest rate or monthly payment, or be allowed to skip payments while you get your finances in order.

- Know what debt settlement means. Debt settlement might be an option to pay less than your current balance to satisfy a debt. However, creditors will generally only accept a settlement offer once you're far behind on your payments. If you're not already behind, trying to settle your debt or working with a debt settlement company can be a risky proposition because you'll purposely miss payments. Your credit score could drop, and interest and fees can accrue as you fall behind.

- Consider bankruptcy as a last resort. Bankruptcy can have severe consequences on your credit and is usually only a last-resort option. However, in some cases, filing for bankruptcy might be the best solution. A bankruptcy can wipe out unsecured debts or get you on a structured repayment plan with your creditors.

What Are Other Tips for Getting Out of Debt?

Here are some more general tips for managing and paying off debt.

- List it all out. List all your debts, their current balances, your monthly payments and the interest rates on each account. Facing the debts directly can be difficult, but you need to know what you're dealing with before you can tackle it all.

- Create a budget. You don't necessarily need to start with a budget that tracks every dollar coming into and out of your accounts. But you can track your spending and then look for ways to reduce your expenses and put the extra money toward your debt.

- Find a community. Sticking with a debt payoff plan can be challenging, especially if you don't have family members or friends who are doing the same thing. Try to find a community online where you can commiserate about the challenges and celebrate your wins.

Get Balance Transfer Card and Debt Consolidation Loan Offers

Whether you're considering a balance transfer card or a debt consolidation loan, comparing the options and your offers can help you find the best card or loan possible. With an Experian account, you can start by checking your credit report and FICO® Score☉ Θ for free. Then, you can log in to your account and get matched with balance transfer card and debt consolidation loan offers from Experian's partners based on your unique credit profile.