In this article:

Your bank account's routing and account numbers are typically needed to set up transfers to and from other bank accounts. Your account number is unique to your checking or savings account, while the routing number is specific to the bank or credit union as a whole.

Importance of Routing and Account Numbers

Banks and credit unions manage tens or hundreds of thousands, and even millions, of accounts. When transferring money to or from your bank account, your routing number and account number are both integral in making sure the money is deposited to or withdrawn from the correct account.

You'll probably need to have these numbers on hand when setting up direct deposit, bill pay and other types of bank transfers. Wire transfers, on the other hand, typically use a different number than your routing number, and you can get that number directly from your bank or credit union.

Find Digital Checking Accounts

What Is a Routing Number?

A routing number is a nine-digit number that identifies the bank or credit union where an account is held. These numbers are also commonly referred to as ABA routing numbers, referring to the American Bankers Association, which assigns them.

Routing numbers are only used within the U.S. and show that the financial institution has an account with the Federal Reserve and is chartered at either the federal or state level.

In most cases, banks and credit unions only have one routing number. But some large national and multinational banks may have multiple routing numbers based on where you live or hold the account.

What Is an Account Number?

While a routing number identifies the bank or credit union that holds your account, an account number identifies your specific account among the many others that the financial institution holds.

For example, if you have more than one checking account or a checking and a savings account with the same institution, the routing numbers will likely be the same, but the account numbers will be different.

Because your account number effectively provides access to the funds in your account, it's critical that you keep it safe.

How to Find Your Routing and Account Numbers

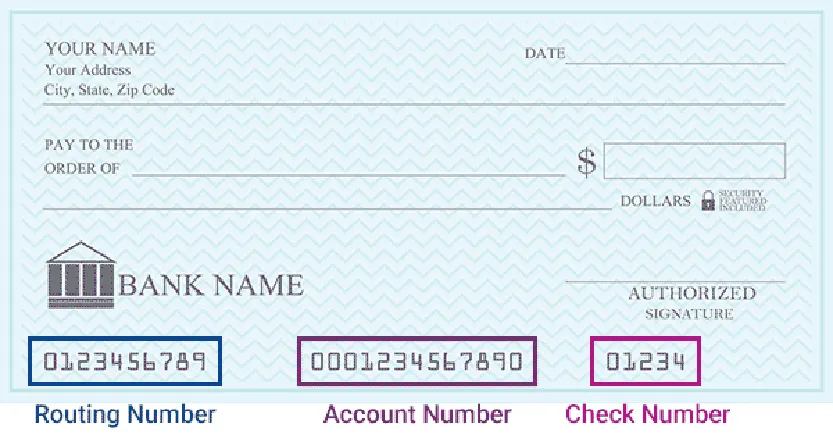

You can find your account and routing numbers at the bottom left-hand side of paper checks that are tied to your checking account, by logging in to your online banking account or by asking a representative of the financial institution.

Since your financial institution's routing number isn't unique to your account, you may be able to simply find it online—just make sure the website you use is the one owned by your bank or credit union. Other websites may gather routing number information for several financial institutions to make things more convenient, but it's best to get the number directly from the institution.

The numbers on the bottom of each of your checks are printed in magnetic ink using what's called magnetic ink character recognition (MICR). The MICR line makes it easier for banks and credit unions to process checks quickly.

When you are ready to provide your routing and account numbers for a bank-related transaction, double-check your sources to make sure you get the numbers exactly correct. If you're off by even a single digit, the transaction won't complete. In some cases, you may be required to enter your account number twice to verify the correct information, which can help avoid potential errors.

The Bottom Line

Your routing and account numbers are necessary for a lot of different bank transactions. They're good to keep on hand in a secure location, but it only takes a moment to find them if you don't have them at the ready when you need them.

Although anyone can find the ABA routing number for your bank or credit union, your account number is not public information, so it's important not to share it unless absolutely necessary to avoid potential fraud. This includes keeping your checkbook away from prying eyes, making sure your bank account password is secure and not sharing pictures of checks you've written on social media.

Learn More About Routing and Account Numbers

- What Is Direct Deposit?

Direct deposit allows you to get your paycheck or government benefits directly to your bank account or prepaid card, sometimes up to two days early. - How Long Does It Take to Transfer Money Between Banks?

Transferring money between banks typically takes one to five days depending on the method you choose. Learn how to choose the best option for you. - What Is the Difference Between ACH and Wire Transfers?

Time is money, including when you’re weighing whether to choose an ACH or a wire transfer. - How to Get Money From a Checking Account Without a Debit Card

You can get cash from your checking account without a debit card by visiting the bank, cashing a check at a store or using a cardless ATM. - 4 Ways to Deposit Cash Into Someone Else’s Account

There are a variety of ways you can deposit money into someone else’s bank account, but rules, fees and limits for depositing cash can vary significantly. - What Are Bank Deposits?

Bank deposits are funds put into a bank account that may earn interest. Bank deposits can be made by cash, check or through electronic transfers like direct deposits and...