Your score falls within the range of scores, from 580 to 669, considered Fair. A 627 FICO® Score is below the average credit score.

Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications. Other lenders that specialize in "subprime" lending, are happy to work with consumers whose scores fall in the Fair range, but they charge relatively high interest rates and fees.

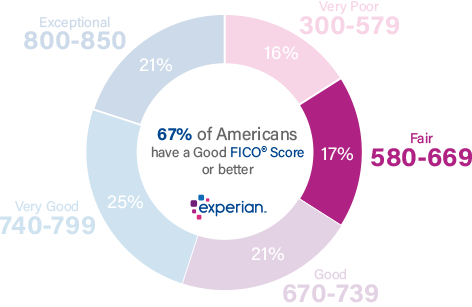

17% of all consumers have FICO® Scores in the Fair range (580-669)

.

Approximately 27% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

How to improve your 627 Credit Score

Think of your FICO® Score of 627 as a springboard to higher scores. Raising your credit score is a gradual process, but it's one you can begin right away.

74% of U.S. consumers' FICO® Scores are higher than 627.

You share a 627 FICO® Score with tens of thousands of other Americans, but none of them has that score for quite the same reasons you do. For insights into the specific causes of your score, and ideas on how to improve it, get copies of your credit reports and check your FICO® Score. Included with the score, you will find score-improvement suggestions based on your unique credit history. If you use those guidelines to adopt better credit habits, your score may begin to increase, bringing better credit opportunities.

From Fair to anywhere: Raising your credit score

A FICO® Score in the Fair range typically reflects credit-management problems or mistakes, such as multiple instances of payments that were missed or paid 30 days late. Consumers with more significant blots on their credit reports, such as foreclosures or bankruptcies, may also see their FICO® Scores rise from the Very Poor range (300-579) into the Fair range once several years have passed after those events.

The credit reports of 42% of Americans with a FICO® Score of 627 include late payments of 30 days past due.

If you examine your credit report and the report that accompanies your FICO® Score, you can probably identify the events that lowered your score. As time passes, those events' negative impact on your credit score will diminish. If you're patient, avoid repeating past mistakes, and take steps that can help build up your credit, your credit scores will likely begin to increase.

Past deeds (and misdeeds) feed your credit score

Credit-scoring systems such as FICO® use information compiled in your credit reports to calculate your score. More recent events in your credit history tend to count more than older activities and, as with any type of analysis, some kinds of information carry more weight than others. Knowing which activities matter most can help you prioritize the steps to take when working toward a better credit score:

Late and missed payments are among the most significant factors to your credit score. More than one-third of your score (35%) is influenced by the presence (or absence) of late or missed payments. Lenders want borrowers who pay their bills on time, and individuals who have missed payments are statistically more likely to default (go 90 days past due without a payment) than those who pay their bills on time. If late or missed payments are part of your credit history, you can do yourself and your credit score a favor by developing a routine for paying your bills promptly.

Utilization rate on revolving credit is responsible for nearly one-third (30%) of your credit score. Utilization, or usage rate, is a technical way of describing how close you are to "maxing out" your credit card accounts. You can measure your utilization on an account-by-account basis by dividing each outstanding balance by the card's spending limit, and multiplying by 100 to get a percentage. You can also calculate your total utilization rate by dividing the sum of all balances by the sum of all spending limits.

| Balance | Spending limit | Utilization rate (%) | |

|---|---|---|---|

| MasterCard | $1,200 | $4,000 | 30% |

| VISA | $1,000 | $6,000 | 17% |

| American Express | $3,000 | $10,000 | 30% |

| Total | $5,200 | $20,000 | 26% |

Most experts agree that utilization rates in excess of 30%— on individual accounts and all accounts in total—tend to lower credit scores. The closer any of these utilization rates gets to 100%, the more it hurts your credit score.

Age is your friend. All other factors being the same, the longer you've been a user of credit, the higher your credit score is likely to be. There's not much that can be done about that if you're a new borrower, and it also doesn't help much if your recent credit history is marred by late missed payments or high utilization rates. If you manage your credit carefully and stay timely with your payments, however, your credit score will tend to increase with time. Length of credit history is responsible for as much as 15% of your credit score.

Your total debt and its composition are responsible for about 10% of your credit score. The FICO® credit scoring system tends to favor individuals with multiple credit accounts, consisting of a mix of installment loans (e.g., car loans, mortgages and student loans, with set monthly payments and fixed payback periods) and revolving credit (accounts such as credit cards that enable you to borrow against a spending limit and make payments of varying amounts each month).

Credit applications and new credit accounts typically have short-term negative effects on your credit score. When borrowers apply for new credit or take on additional debt, they assume greater risk of being able to pay their bills. Credit scoring systems like FICO® typically cause scores to dip a bit when that happens, but scores will typically rebound within a few months as long as you keep up with all your payments. New-credit activity can contribute up to 10% of your overall credit score.

Public records such as bankruptcies have severe negative impacts on your credit score if they appear on your credit report. Because they do not appear in every credit report, these entries cannot be compared to other credit-score influences in terms of percentage, but they can eclipse all other factors and severely lower your credit score. A bankruptcy, for instance, can remain on your credit report for 10 years, and may effectively prevent you from getting credit for much or all of that time.

Improving Your Credit Score

Fair credit scores can't be made into exceptional ones overnight, and bankruptcies, foreclosures and some other negative issues that contribute to Fair credit scores only resolve themselves with the passage of time. But no matter the cause of your Fair score, you can start handling credit more, which can lead in turn to credit-score improvements.

Seek a secured credit card. A secured card can benefit your credit score, even if you don't qualify for traditional credit cards. Once you've confirmed that the lender reports card activity to the national credit bureaus, you put down a deposit in the full amount of your spending limit—typically a few hundred dollars. When you use the card and make regular payments, those activities will be recorded in your credit files. And as long as you keep your usage rate on the card below about 30%, and stay on schedule with your monthly payments, they'll help you build stronger credit.

Consider a credit-builder loan. As the name implies, these are specialty loans designed to help build or shore up borrowers' credit profiles, by demonstrating the ability to make regular monthly payments. When you take out one of these loans, the credit union places the money you've borrowed in a savings account that generates interest. Once you've paid off the loan, you get the cash and the interest it has accrued. It's a neat savings tool, but the real payoff comes as the credit union reports your payments to the national credit bureaus, which can lead to credit-score improvements. (Double-check with the lender to make sure they report activity to all three national credit bureaus before you apply for a credit-builder loan.)

Consider a debt-management plan. A debt-management plan (DMP) can be helpful to borrowers who find themselves overextended and unable to keep up with credit payments. Working in conjunction with an authorized credit-counseling agency, you negotiate a manageable repayment schedule, effectively closing all your credit accounts in the process. This is a major step that can seriously harm your credit score in the near-term, but it's less damaging than bankruptcy and can eventually give you a clean start on rebuilding your credit. Even if a DMP isn't for you, a good non-profit credit counselor (as distinct from credit-repair company) can help you find strategies for building up your credit.

Pay your bills on time. If you could do only one thing to improve your credit score, nothing would help more than bringing overdue accounts up to date, and avoiding late payments as you move forward. Do whatever you can to remind yourself to pay the bills on time: Use automatic payments, set calendar alarms, or just write yourself notes and pin them where's you'll see them. Within a few months you'll train yourself in habits that promote higher credit-scores.

Avoid high credit utilization rates. Credit utilization, or debt usage, is the basis for about 30% of your FICO® Score. Keep your utilization rate below about 30% can help you avoid lowering your score.

Among consumers with FICO® credit scores of 627, the average utilization rate is 67.9%.

Try to establish a solid credit mix. You shouldn't take on debt you don't need, but prudent borrowing, including a combination of revolving credit and installment debt, can be beneficial to your credit score.

Learn more about your credit score

A 627 FICO® Score is a good starting point for building a better credit score. Boosting your score into the good range could help you gain access to more credit options, lower interest rates, and fewer fees. You can begin by getting your free credit report from Experian and checking your credit score to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.